Option Pricing Models and Volatility

(税込) 送料込み

商品の説明

Option Pricing Models and Volatility Using Excel-VBA (Wiley Finance)

蛍光ペンで線を引いた箇所がございます。

VBAコードのCD付きです。商品の情報

| カテゴリー | 本・音楽・ゲーム > 本 > 洋書 |

|---|---|

| 商品の状態 | やや傷や汚れあり |

Option Pricing Models and Volatility Using Excel-VBA

Option Pricing Models and Volatility Using Excel-VBA

Option Pricing Models and Volatility Using Excel-VBA

Option Pricing Models and Volatility... by Rouah, Fabrice D.

![Option Pricing Models and Volatility Using Excel-VBA [With CD-ROM] - (Wiley Finance) by Fabrice Douglas Rouah & Greg Vainberg (Paperback)](https://target.scene7.com/is/image/Target/GUEST_d05c363a-d2bc-460d-afb1-cbab1fd00dfa?wid=488&hei=488&fmt=pjpeg)

Option Pricing Models and Volatility Using Excel-VBA [With CD-ROM] - (Wiley Finance) by Fabrice Douglas Rouah & Greg Vainberg (Paperback)

Decoding Option Pricing: A Deep Dive into Theories, Models, and

Option Volatility and Pricing: Advanced Trading Strategies and Techniques, 2nd Edition

Option Pricing Models and Volatility Using Excel-VBA

Decoding Option Pricing: A Deep Dive into Theories, Models, and

Decoding Option Pricing: A Deep Dive into Theories, Models, and

Basic Option Volatility Strategies - National Library Board

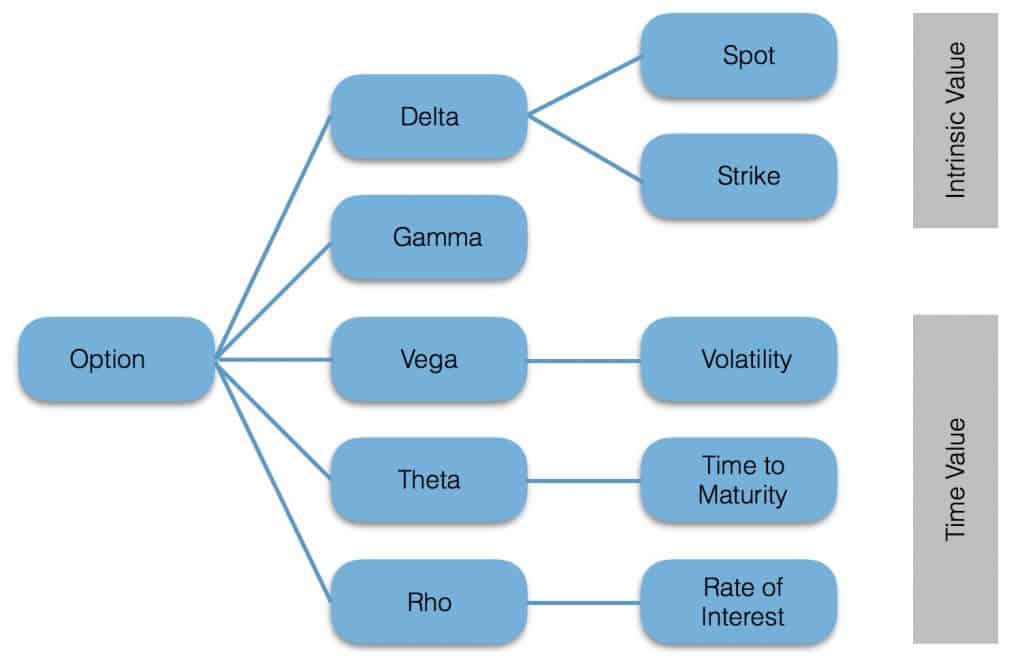

An Intuitive Understanding of the Option Greeks

Volatility on Option Pricing - FasterCapital

Basic Option Volatility Strategies: Understanding Popular Pricing Models

:max_bytes(150000):strip_icc()/ProfitFromVolatility1-4f68837d0ec244df8eb775a9e65bcf40.png)

How to Profit from Volatility

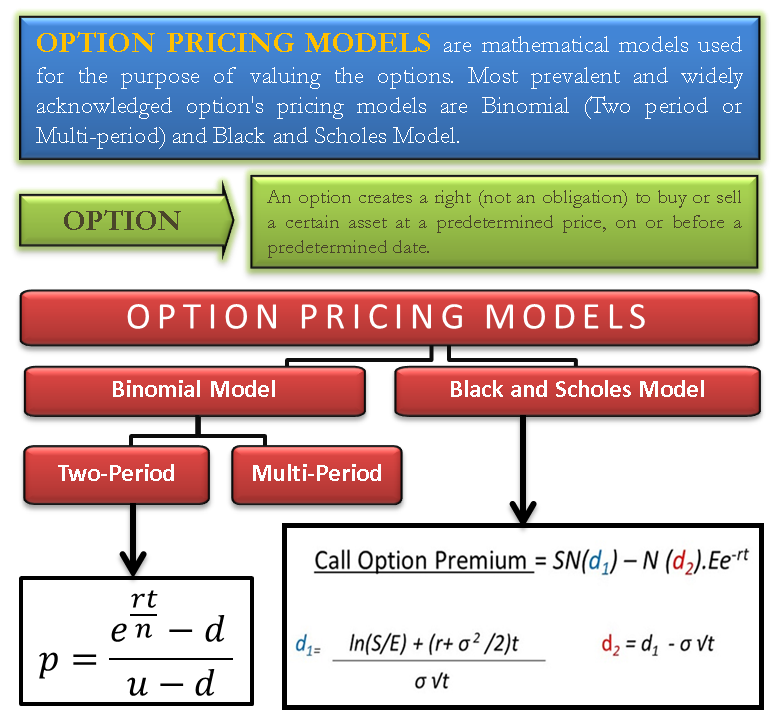

Option Pricing Models - Definition, Types, How to Use

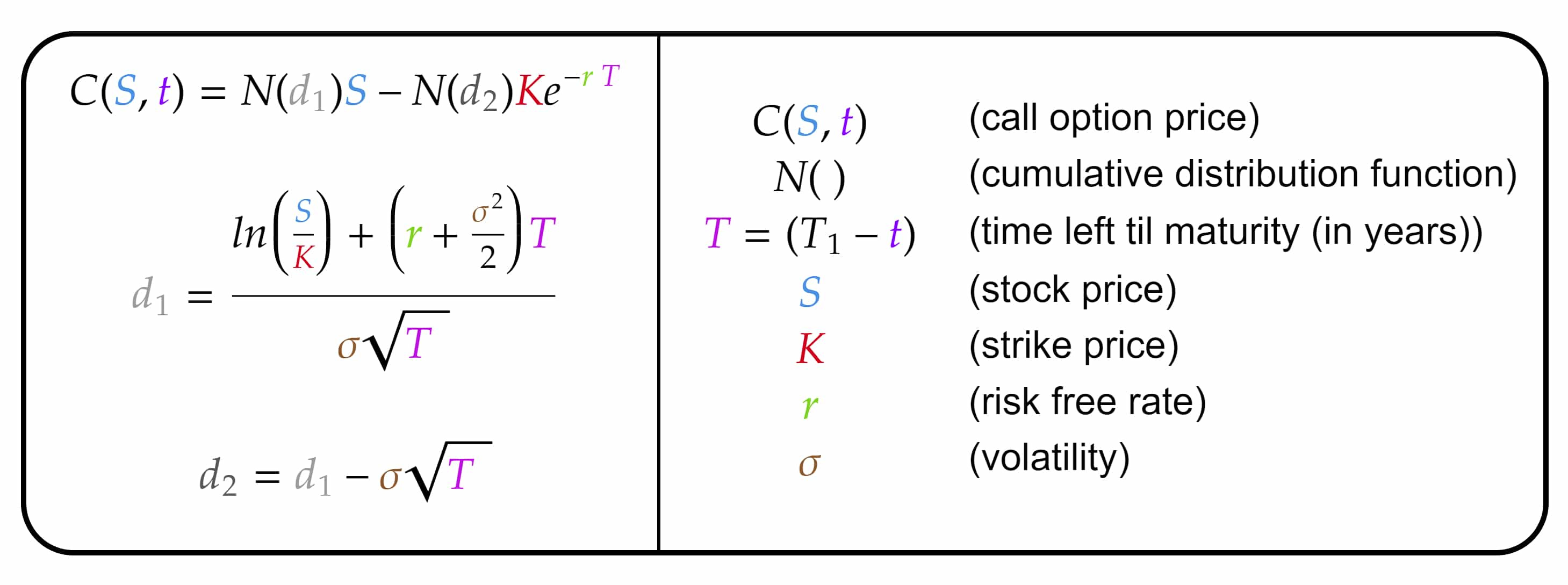

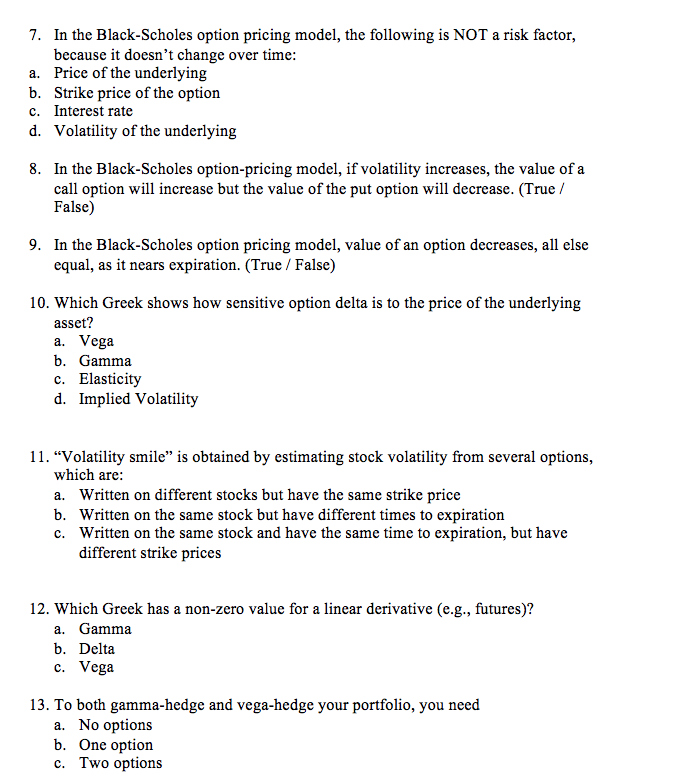

Solved 7. In the Black-Scholes option pricing model, the | Chegg.com

Options Pricing Model - FasterCapital

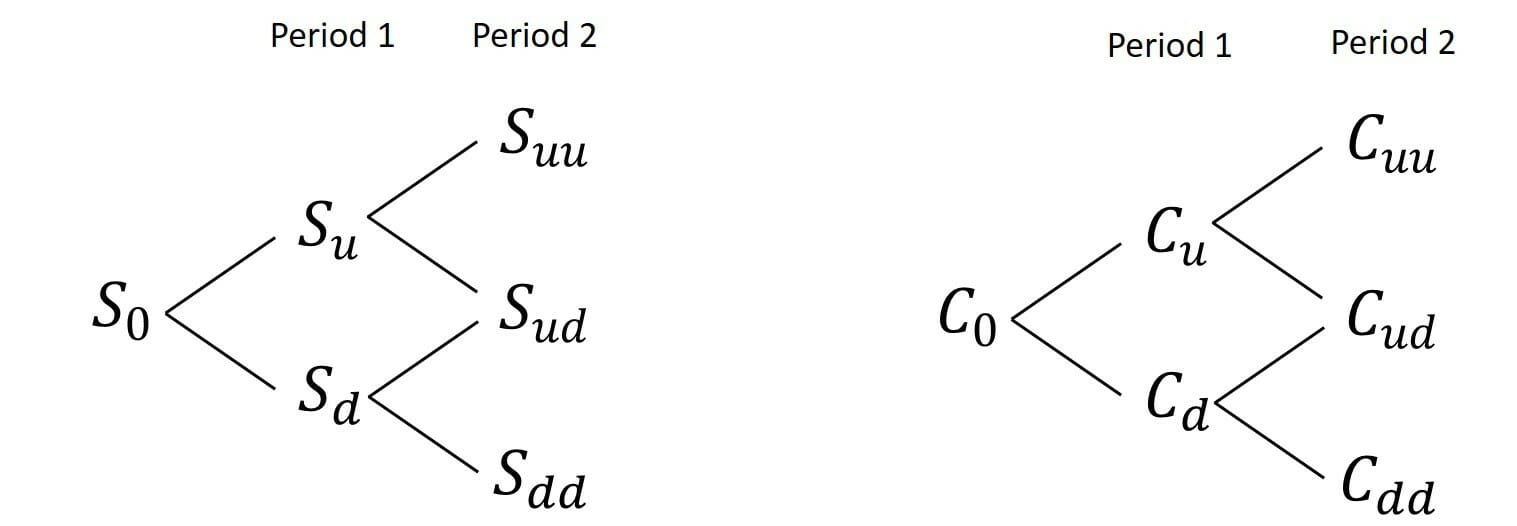

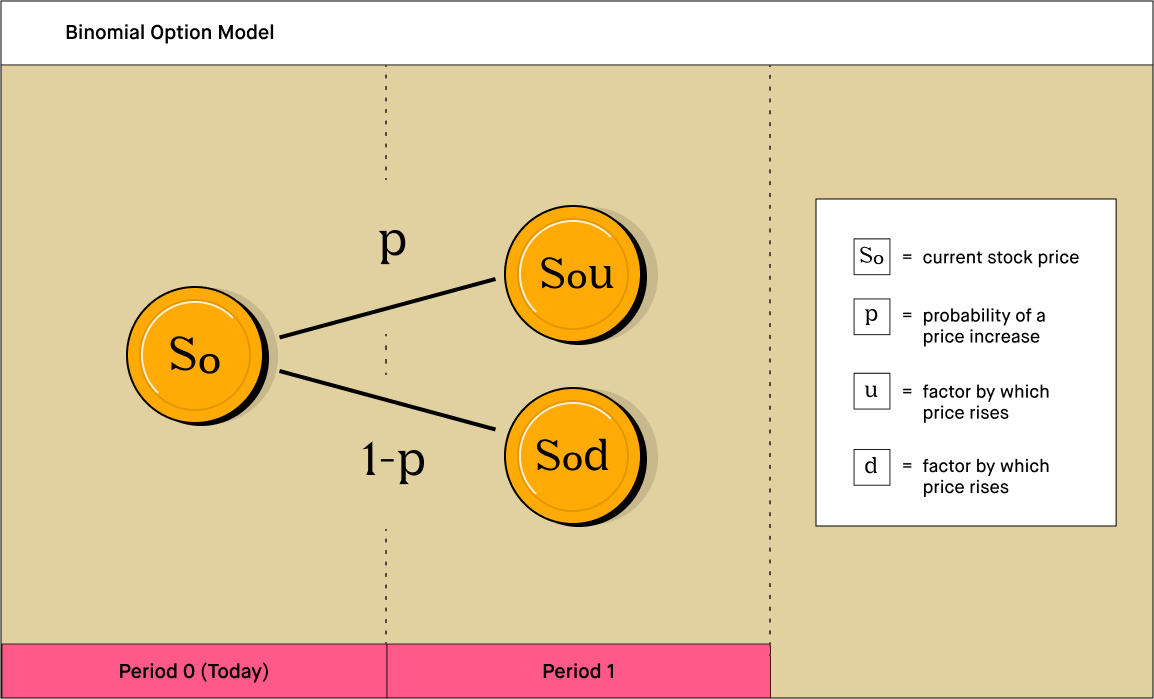

What is the Binomial Option Pricing Model? - 2023 - Robinhood

Mathematics | Free Full-Text | On the Class of Risk Neutral

Chapter 8: Option pricing

:max_bytes(150000):strip_icc()/dotdash_v3_Understanding_the_Binomial_Option_Pricing_Model_Nov_2020-05-500799e2262748cab1214eb73e2132c4.jpg)

Lattice-Based Model: What it Means, How it Works

A Primer on Option Pricing Models - Bamboos Consulting

Option Pricing Model - Definition, History, Models, & Examples

Option Volatility & Pricing: Advanced Trading Strategies and Techniques

A New Option Pricing Model and Volatility Smile

Complete Guide to Options Pricing | Option Alpha

Option Pricing Models Option Pricing Models - FasterCapital

The American put option price in Heston's stochastic volatility

Advanced Options Modeling, Pricing, & Volatility

The Black-Scholes and Heston Models for Option Pricing | Semantic

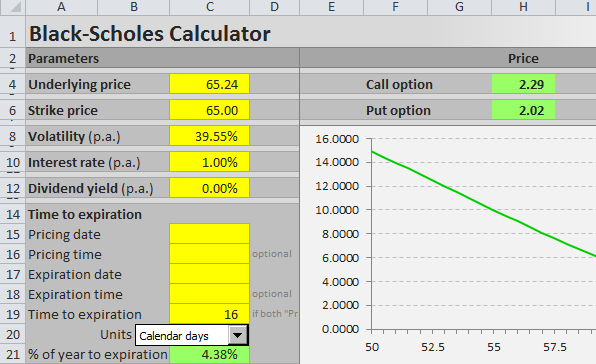

Black-Scholes Excel Formulas and How to Create a Simple Option

:max_bytes(150000):strip_icc()/binomialoptionpricing.asp-final-2a396cf736bc44dcbbf4dff26fa06684.png)

Binomial Option Pricing Model Definition

The maximum vanilla option price in the binomial model, compared

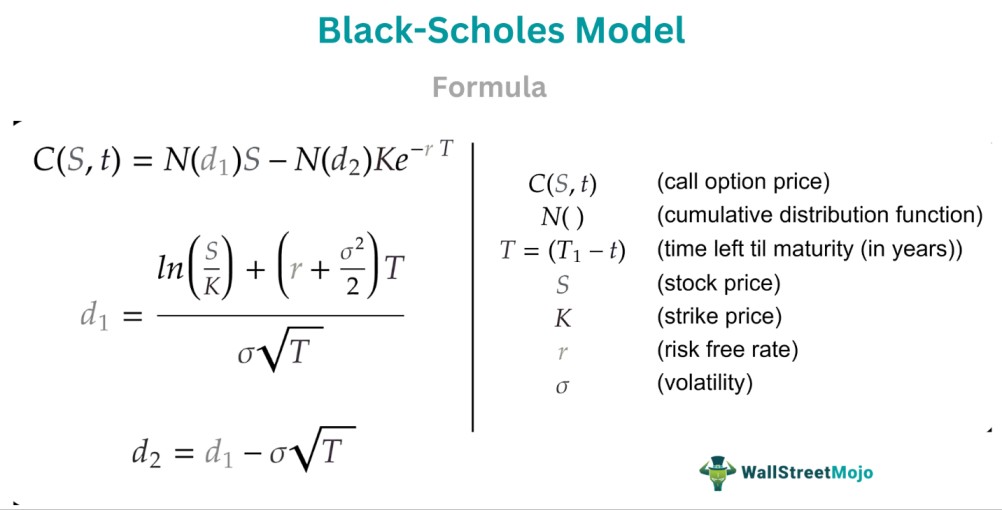

Black-Scholes Model (Option Pricing) - Meaning, Formula, Example

Options Pricing Model - FasterCapital

Options Pricing Models - Financial Edge

What is the Option Pricing Model (“OPM”)?

The annualized implied volatility of the RCA-GARCH option pricing

Beyond Black Scholes: Enhancing Option Pricing with JarrowTurnbull

商品の情報

メルカリ安心への取り組み

お金は事務局に支払われ、評価後に振り込まれます

出品者

スピード発送

この出品者は平均24時間以内に発送しています